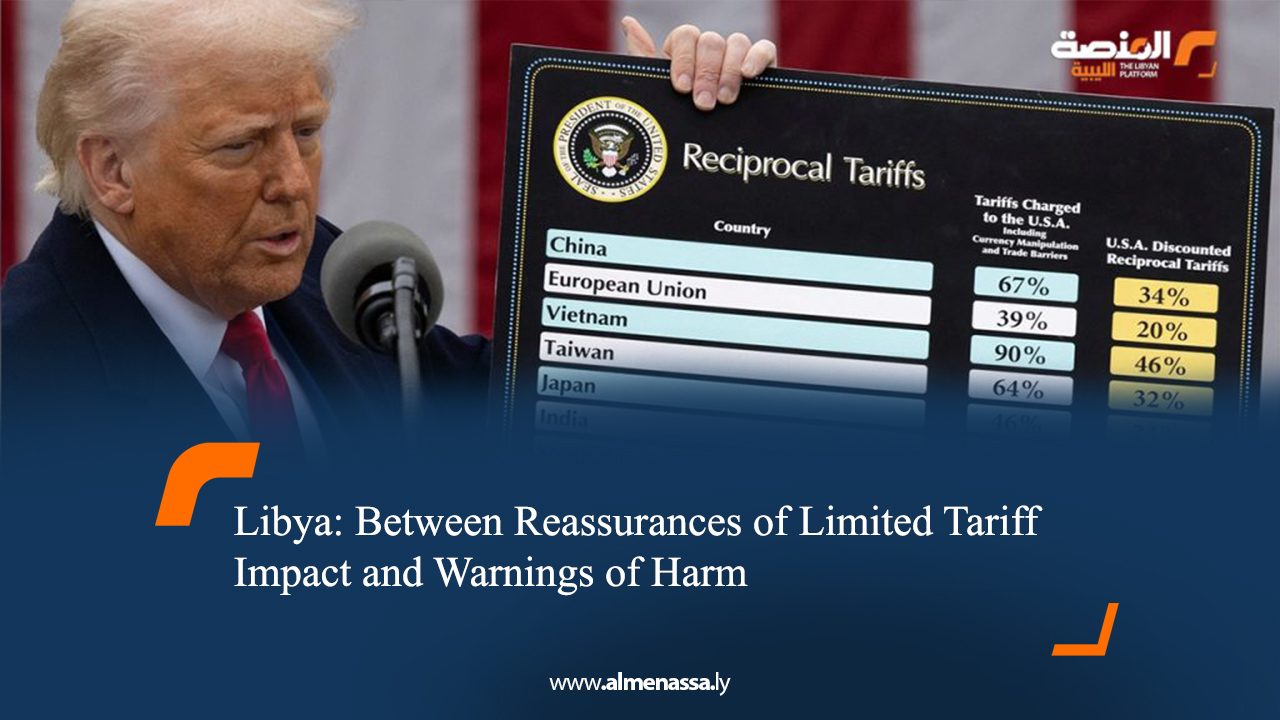

US President Donald Trump has dispatched a message to the Head of the Government of National Unity, Abdelhamid Dabaiba, regarding a decision to impose a 30% tariff on imports from Libya, set to take effect from August 1st.

Trump cited what he described as a “significant trade deficit” with Libya, asserting that the United States would continue to work with the country towards “more balanced and fair trade.”

The US President stated that his country, following years of extensive discussions on trade relations with Libya, concluded the necessity to “address these long-standing and persistent trade deficits, resulting from Libya’s tariff and non-tariff policies and trade barriers.”

He added: “We will impose a tariff of only 30% on all Libyan products sent to the United States, separate from all sectoral tariffs.” He deemed the 30% rate “significantly less than what is required to close the trade deficit gap between the two countries.”

Trump’s decision exempted companies operating in Libya that choose to “manufacture or produce products within the United States” from these tariffs. He further warned: “If, for any reason, you decide to raise your tariffs, whatever amount you choose will be added to the thirty percent rate we impose.”

No Alternatives to the US Market

For his part, economic analyst Adel Al-Maghrahi affirmed that while the tariffs on Libya might appear shocking initially, their impact remains symbolic as long as they do not include the oil sector.

Al-Maghrahi noted that Libya lacks clear commercial alternatives to US markets and possesses an inflexible export structure that prevents quick adaptation to such changes. He explained that worse still, if Washington uses these tariffs as leverage in the future, particularly if relations with American companies operating in the oil sector falter, an economic escalation could reshape the dynamics of the relationship between the two countries.

He added that any disruption in relations with a major importer, even if its effect is limited, could negatively impact the local market and raise concerns about the exchange rate of the Libyan Dinar against the US Dollar.

Libya’s Limited Exports

Meanwhile, economic analyst Mohamed Al-Shibani viewed President Trump’s decision to impose tariffs on Libya as primarily political rather than economic. He justified this by stating that Libya’s exports to the United States are very limited, almost exclusively confined to oil, which is typically exempted from such tariffs.

Al-Shibani indicated that these measures send negative signals to Libya’s investment environment and underscore the fragility of Libyan commercial relations with external partners. He pointed out that Libya might be among the least directly affected countries commercially but is, conversely, among the most economically vulnerable.

He also warned that any shock, even if symbolic, could impact Libya’s ability to attract foreign investments or effectively negotiate with international partners.

Increase in Equipment Prices

In a related context, Abdul Rahman Oraibi, owner of a medical equipment supply company, stated that the impact of customs tariffs on Libyan markets would manifest as an increase in the prices of many devices used in Libyan hospitals and universities, as they are manufactured in the United States.

He clarified that any increase in the price of these devices or their maintenance costs could negatively affect the quality of health and educational services, potentially burdening citizens with additional financial costs.

Oraibi noted that some specialised American goods, such as medical equipment or components for energy systems, are not easily replaced in the international market. He indicated that imposing additional fees on these goods could lead to a sharp decline in import volumes due to increased costs, potentially causing severe shortages within the Libyan market.

Between reassurances regarding the limited impact of tariffs imposed on Libya and warnings about the actual effects of the tax, concerns emerge about Libyan citizens bearing additional costs if the impacts prove substantial